Life is about finding balance. The same holds true for our electric grid. Just like we need the right tools to help us remain stable, our grid needs the systems and controls to ensure electricity consumption matches production at any given moment. When it doesn’t, the grid can become overloaded or experience electricity shortages that lead to blackouts. This is especially true in California, the poster child of our climate crisis.

Over the years, different policies have been put in place to reduce greenhouse gas emissions and encourage private investment in clean energy. One of the most successful solar policies is net energy metering (NEM).

Designed to incentivize homeowners to go solar, net metering allows solar customers to send their excess generation to the grid in exchange for credits on their electric bill. Since it was enacted in 1996, net metering has helped drive solar installs on 1.5 million California rooftops.

What Happens with NEM 3.0?

Citing the need to address grid reliability shortfalls, the California Public Utilities Commission (CPUC) in December of 2022 voted to adopt the third version of net metering policy, NEM 3.0.

In a move that drastically reduces the value of new standalone rooftop solar, the CPUC decided to drive storage adoption by reducing the credit rate for exported solar by 75%. By devaluing solar-only systems to such a degree, the new policy ― now called net billing ― nearly doubles the length of time before customers can break even on their rooftop solar investment, which slashes the overall savings potential.

Now that NEM 3.0 is in effect, solar systems make a lot more financial sense by adding battery storage (or by cutting the size of a solar system in half to offset the steep drop in export credit value).

As more distributed storage comes online, customers will be looking for ways to maximize the value of their solar plus storage systems, in the hopes of breaking even sooner.

The Need to Balance Electricity Supply and Demand

Thanks largely to net metering policy, the Golden State now has roughly 12 gigawatts of distributed solar online, equal to about 25% of California’s peak electricity demand.*

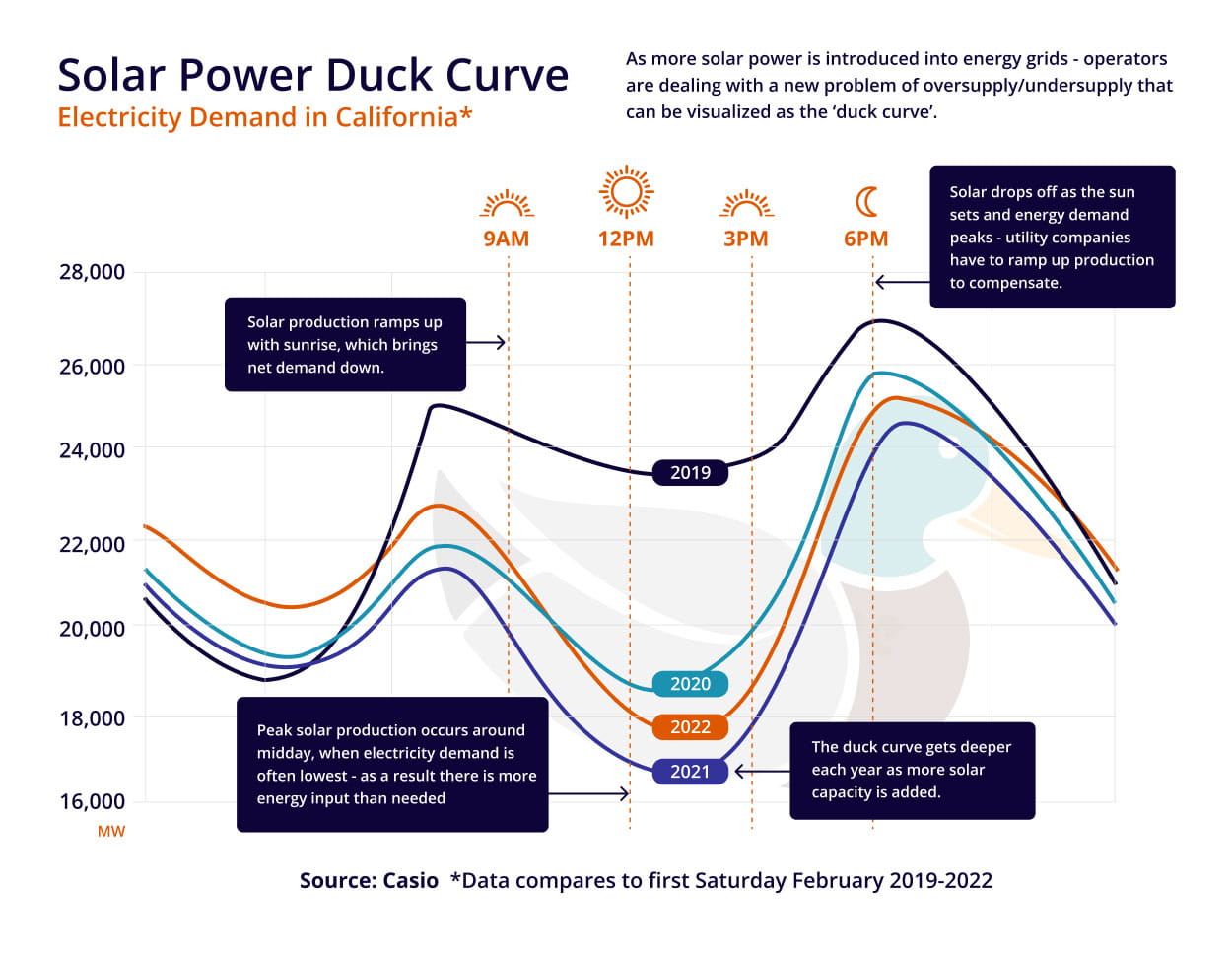

Over the past decade, as more rooftop solar has come online, it’s created a so-called “duck curve.” The lines that rise and fall represent the imbalance between energy supply and demand, mimicking the shape of this water bird as the discrepancy grows.

The duck curve illustrates how the demand for electricity from the grid drops during the day when solar output is the highest and then ramps up in the evening, after the sun goes down and solar production tapers off.*

The result? An insufficient amount of electricity from the grid during peak evening demand, which can create a serious issue during heatwaves, like the one before Labor Day.

The CPUC hopes that by moving California to a solar-plus-storage market, the state can better balance its electricity supply and demand. But the new net billing policy requires a higher investment in solar, now that batteries are essential.

So, how can the industry promise economic value for solar + storage systems to continue attracting new customers?

One way is through a virtual power plant.

What is a Virtual Power Plant?

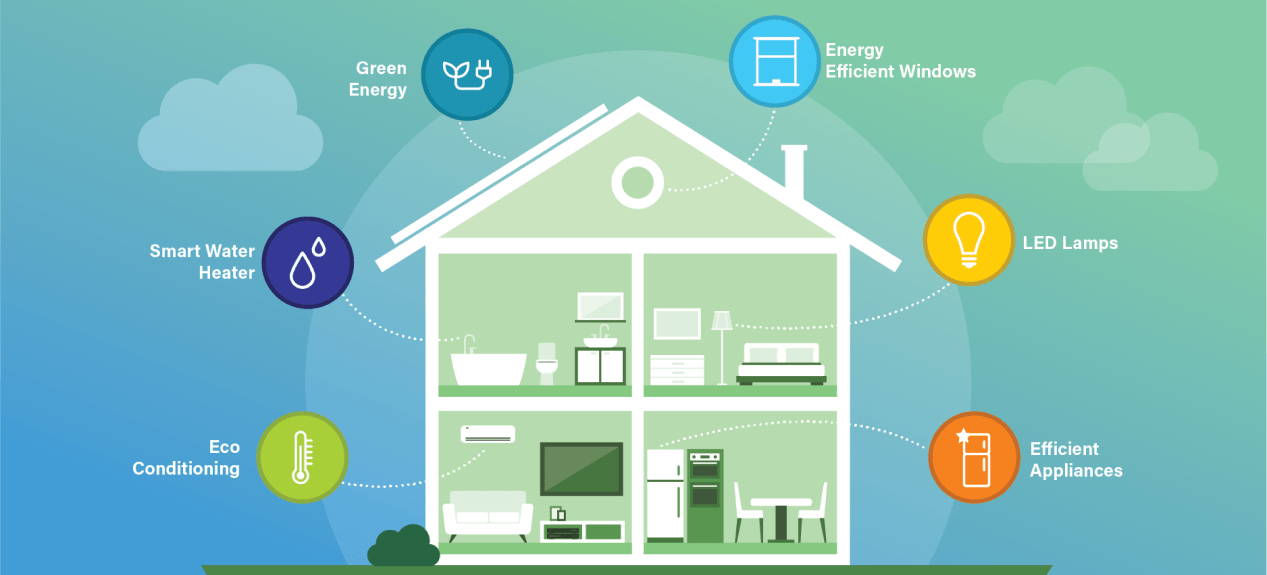

Believed by many to be the future of distributed energy, virtual power plants (VPPs) can control the output from a collection of home solar batteries and replicate a traditional power plant.

Using software, a VPP combines stored power from a number of independent sources located at different sites to create a network that supplies power around the clock.

Because there’s no ramp-up period, these VPPs can replace dirty “peaker plants” to address spikes in electricity demand. Unlike baseload power plants that supply a steady stream of electricity, peaker plants are only used on occasion but are highly polluting, as they ramp up quickly and are generally inefficient.

Why Participate in a Virtual Power Plant?

In recent years, as severe weather has become the norm in California, more homeowners began installing battery backup to store their solar power for nighttime or grid outages.

By participating in a virtual power plant, battery customers can agree to dispatch some of their stored energy when the grid needs it most — and receive compensation in the form of payments or bill credits.

The concept of joining a VPP is similar to solar net metering, but for a battery. NEM 2.0 established time of use (TOU) rates (soon to be replaced by electrification rates under NEM 3.0) that charge a higher price for electricity during times of peak demand.

- With TOU, solar customers are rewarded with higher credit rates for sending their excess solar power to the grid when demand soars and the grid becomes unstable (think hot summer evenings).

- With a VPP, battery customers are similarly rewarded for helping the grid during high-stress times.

When is a VPP Most Beneficial?

Here are a few instances that allow solar batteries to be compensated for VPP participation:

The more California utilities scramble to ensure power reliability during severe weather, the more we can expect them to encourage participation in VPP programs.

- Extreme Heat: In early September of 2022, electricity demand soared to record levels when temperatures surpassed 100 degrees in the San Francisco Bay Area. Ratepayers responded to an emergency alert by reducing their energy use and helped avert a blackout. Storage can do much more to reduce demand during emergencies when customers are signed up in advance through a VPP program.

- Wholesale Energy Price Spikes: VPPs can also target spikes in the wholesale market price of energy. By dispatching energy at the exact moment when energy prices spike (as was the case during Winter Storm Uri in Texas, when wholesale prices maxed out at $9,000/MWh*), a VPP can shave the tops off those spikes and lower prices across the board.

- Critical Infrastructure: It can be dangerous, even deadly, when conventional power plants fail and emergency equipment and hospitals are forced offline. During a widespread outage, a VPP can detect when the grid is stressed and automatically redistribute energy loads to spare critical energy assets. VPPs can also prevent unexpected power surges from damaging electrical equipment, adding an element of safety to a potentially hazardous situation.

With results that range from potentially lowering energy costs to providing additional value for solar plus storage to improving flexibility for grid operators, VPPs may very well be the future of energy.

Solar Storage Makes Sense Under NEM 2.0 and NEM 3.0 Rates

While there’s a particular push for storage under the NEM 3.0 rate structure, customers under NEM 2.0 will still benefit from adding batteries. For Californians who already have solar installed, adding storage to your system has become more affordable, thanks to the new incentives provided by the Inflation Reduction Act (IRA).

Passed in August of 2022, the IRA provides qualifying customers who own their systems with up to a 30% federal income tax credit, not only for residential solar panels, but for solar plus battery storage and even standalone storage systems for systems 3 kWh or greater installed before Dec. 31, 2034.

Both customers who go solar with battery storage under NEM 2.0 and NEM 3.0 can support their own resiliency if the grid goes down, and provide a collective benefit to improve energy security for all ratepayers, too.

There’s Nothing to Lose But CO2 Emissions

By joining a VPP, you can boost the value of your solar and storage system, strengthen your community’s energy resilience and play an active role in the transition to clean energy.